pa auto sales tax calculator

The city of Philadelphia imposes an additional two percent raising the rates in that city. Mortgage Loan Auto Loan Interest Payment Retirement.

Car Sales Tax In Indiana Getjerry Com

26 rows Select location.

. The sales tax rate for Allegheny County is 7 and the sales tax rate in the City of Philadelphia is 8. The state in which you live. Dealership employees are more in tune to tax rates than most government officials.

The type of license plates requested. Your household income location filing status and number of personal exemptions. If you live outside of Larimer county or need to calculate sales tax rates for other purchases besides motor vehicles this tool may not provide the correct information.

Once you have the tax. 72201-1400 is sample zip code for Look-up Tool. The statewide base sales tax rate in Pennsylvania is 6.

Whether or not you have a trade-in. Before-tax price sale tax rate and final or after-tax price. This Auto Loan Calculator automatically adjusts the method used to calculate sales tax involving Trade-in Value based on the state provided.

For vehicles that are being rented or leased see see taxation of leases and rentals. To find out more about our finance specials please feel free to. 70 0065 455.

Its fairly simple to calculate provided you know your regions sales tax. TAX DAY NOW MAY 17th - There are -397 days left until taxes are due. Its fairly simple to calculate provided you know your regions sales tax.

Dealership employees are more in tune to tax rates than most government officials. The state sales tax rate in Pennsylvania is 6000. New car sales tax OR used car sales tax.

Passenger vehicle traction law. 65 county city rate on 1st 2500. Pennsylvania Vehicle Registration Taxes Fees.

For example the rate in Allegheny County is seven percent and that in Philadelphia County is eight percent. 54 rows The Sales Tax Calculator can compute any one of the following given inputs for the remaining two. According to the.

505 Based on 1500 Google Reviews SALES 718 616-CARS. Pennsylvania has a 6 statewide sales tax rate but also has 68 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0166 on. View chart find city rate find county rate apply car tax rate formula.

Pennsylvania sales tax is 6 of the purchase price or the current market value of the vehicle 7 for residents of Allegheny County and 8 for City of. If you are unsure call any local car dealership and ask for the tax rate. Some counties impose additional surtaxes however.

View pg 1 of chart find total for location. Pennsylvania sales tax is 6 of the purchase price or current market value of the vehicle 7 for Allegheny County and 8 for the City of Philadelphia. Sales tax in the Pennsylvania is fixed to 6.

Average Local State Sales Tax. 70 455 7455. 56 county city.

Vehicle tax or sales tax is based on the vehicles net purchase price. Any vehicle thats designed to be used on the highway whether its a sedan boat trailer camper or even a mobile home is subject to sales tax because it is personal property. Thats not including any city or county taxes that could be added on top of that.

List price is 90 and tax percentage is 65. The state sales tax rate for leasing a motor vehicle in Pennsylvania is six percent. These fees are separate from the taxes and DMV.

States that do not have a trade-in tax credit policy do not get any tax savings. The county the vehicle is registered in. Maximum Local Sales Tax.

Divide tax percentage by 100. This tool is designed for calculating the sales tax rates for residents of Larimer County who purchased a motor vehicle on or after January 1st 2019. Select Community Details then click Economy to view sales tax rates.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

Home Motor Vehicle Sales Tax Calculator. Multiply price by decimal tax rate. Motor vehicle titling and registration.

72201-1400 is sample zip code for Look-up Tool. The Department collects taxes when an applicant applies for title on a motor vehicle trailer all-terrain vehicle boat or outboard motor unit regardless of the purchase date. 65 100 0065.

Select the Pennsylvania city from the list of popular cities below to see its current sales tax rate. Add tax to list price to get total price. If you were to buy a 25000 car and had a trade-in worth 15000 your sales tax would be on 10000 instead of the full 25000.

Pennsylvania State Sales Tax. For instance if your new car costs you 25000 you can expect to pay an additional 1500 in state sales tax alone. Call PA Auto Sales Today Take advantage of our current finance deals to lock in savings today.

With local taxes the total sales tax rate is between 6000 and 8000. Tax and Tags Calculator. 600 Pennsylvania State Sales Tax -400 Maximum Local Sales Tax 200 Maximum Possible Sales Tax 634 Average Local State Sales Tax.

Pennsylvania collects a 6 state sales tax rate on the purchase of all vehicles with the exception of Allegheny County and the City of Philadelphia. 30000 8 2400. Try our FREE income tax calculator.

You will pay 455 in tax on a 70 item. Signature Auto Group of New York is the premiere Car Lease Experts and for those looking at pa sales tax on cars Auto Leases more. 65 county city rate on 1st 2500.

Vehicle tax or sales tax is based on the vehicles net purchase price. For additional information click on the links below. With local taxes the total sales tax rate is between 6000 and 8000.

The calculator above is based on the following formula. The car sales tax in Pennsylvania is 6 of the purchase price or the current market value of the vehicle according to the PennDOT facts sheet. Maximum Possible Sales Tax.

The price of the coffee maker is 70 and your state sales tax is 65. If you trade in a vehicle only the difference between the value of the trade-in vehicle and the purchase price of the new vehicle is taxed. When purchasing a vehicle the tax and tag fees are calculated based on a number of factors including.

Trade-in value tax rate tax savings. Vehicle Tax Costs. Using the values from the example above if the new car was purchased in a state without a sales tax reduction for trade-ins the sales tax would be.

Wix Stores Setting Up Manual Tax Calculation Help Center Wix Com

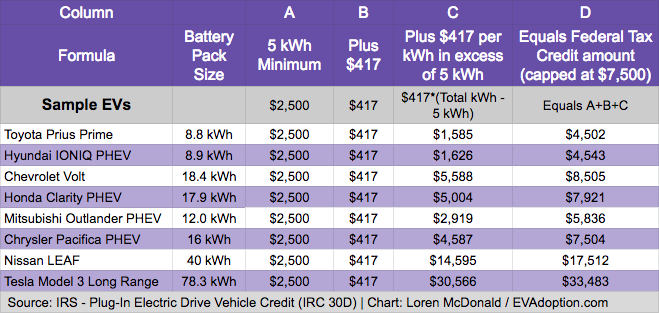

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

Used Cars In Leduc Ready For You House Of Cars Calgary

Sales Tax Liability 5 Things To Know For Your Shopify Store Taxjar

What Are The Mileage Deduction Rules H R Block

How Much Car Can You Afford Car Affordability Calculator Canada

A Guide To Company Car Tax For Electric Cars Clm

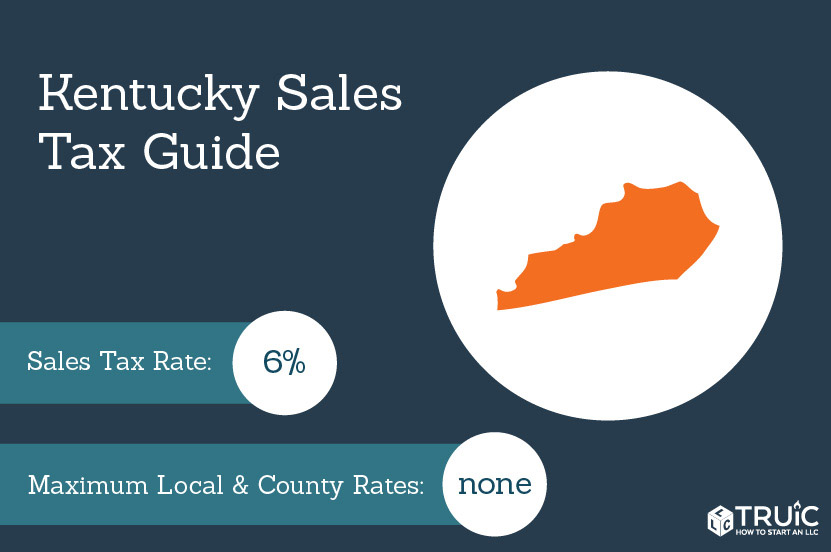

Kentucky Sales Tax Small Business Guide Truic

Auto Lease Buyout Calculator How Much To Buy Your Leased Vehicle Nerdwallet

How Much Car Can You Afford Car Affordability Calculator Canada

Wix Stores Setting Up Manual Tax Calculation Help Center Wix Com

California Sales Tax Calculator

Wix Stores Setting Up Manual Tax Calculation Help Center Wix Com

Tax On Test Do Britons Pay More Than Most Tax The Guardian

Sales Tax Liability 5 Things To Know For Your Shopify Store Taxjar